Financial Data Exchange encourages major finance groups to join its ranks

Financial data sharing has become a huge talking point in the online banking world as customers are becoming more and more aware of the power and value of their own personal data. Evie Rusman takes a look at the emergence of the Financial Data Exchange (FDX) and analyses its importance in a data sharing world

In an age where data sharing is becoming increasingly easier, consumers are continually demanding more control over their data. This has led to added pressure being put on fintechs and banks to adapt and become more transparent.

As a result, FDX has taken it on itself to find a solution to this ever expanding issue in an attempt to keep customers, the industry and regulators happy.

Through using an API and educating businesses on the importance of data sharing, FDX hopes to solve the issues facing the industry and please everyone.

What are the solutions? Speaking to Verdict Payments, Don Cardinal, managing director at FDX, explains how they hope to encourage financial institutions to join forces.

“Our aim is to establish a group of the leading global financial institutions, fintechs, data aggregators and industry associations. The mission is to unite the financial industry around a common, interoperable royalty-free standard, making consumer and business access to financial data more secure and convenient.

“At a time when interest in, and movement towards more open banking systems globally is in full swing, we believe that by providing this forum, listening to all industry voices, and leveraging their expertise, we offer the shortest critical path to secure consumer-permissioned financial data sharing.”

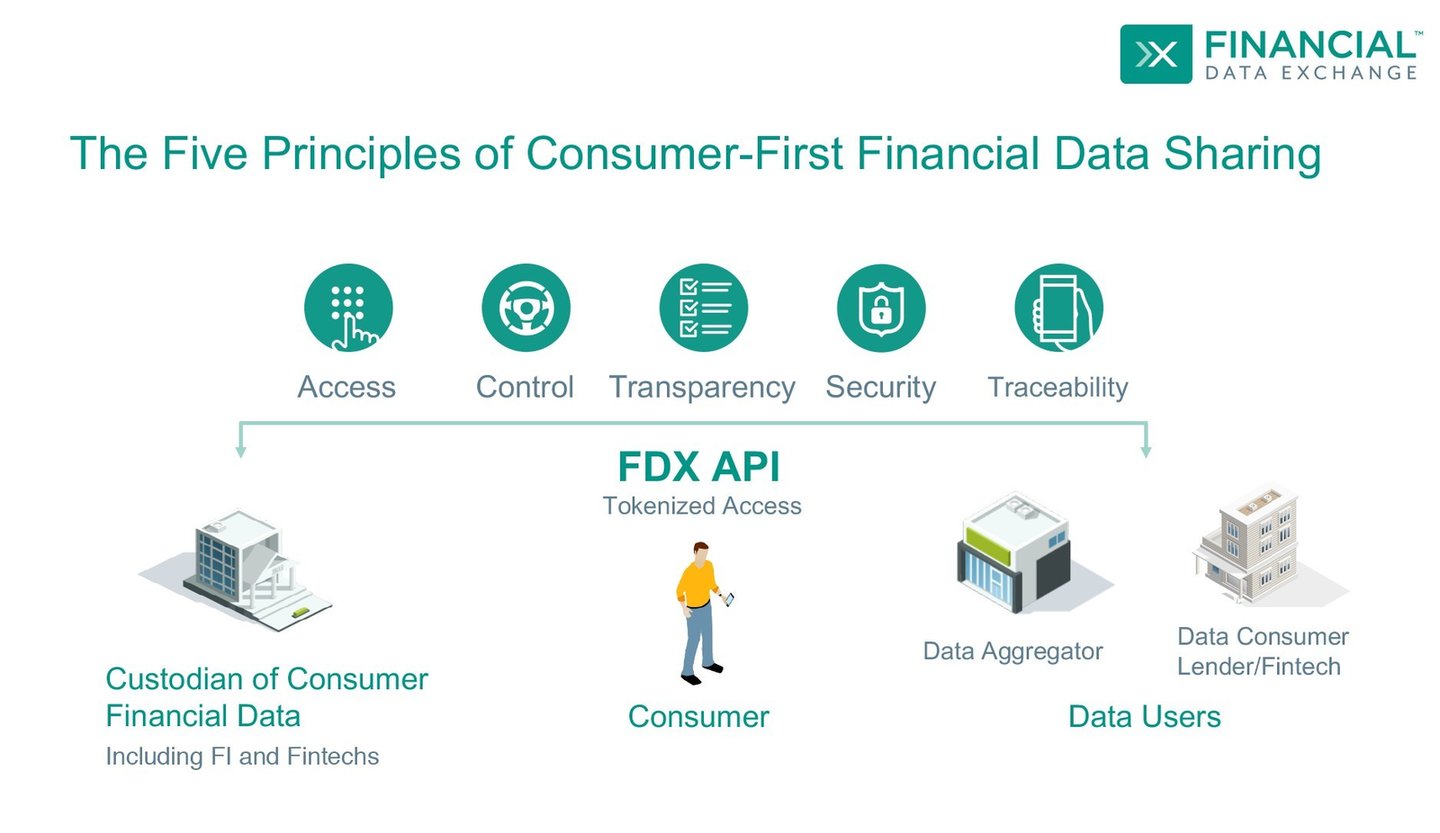

Cardinal emphasises how FDX want to put the consumer first, which was taken into account when designing the FDX API. He also says how there are five main principles when it comes to data sharing.

Who are the members?

With 55 current members, Mastercard and Visa are the latest institutions to join FDX alongside members such as Bank of America and Capital One.

Speaking on this, Cardinal says: “We’re obviously very pleased to have two of the biggest global card networks on board, and we’re looking forward to leveraging their unique insights to making the FDX API even better.

“We’re grateful to have the support of a variety of large financial institutions and innovative companies across the financial ecosystem – including our founding members.”

Cardinal stresses the importance of attracting smaller fintechs and encouraging them to join. He explains that it is not just the bigger organisations that matter.

He adds: “I do want to point out that in order to achieve our mission of becoming the global industry standard, we need the voices of smaller financial institutions, fintechs and industry players too.

“All industry voices matter, as does the perspective of consumer advocacy groups. The way we're structured, every organisation that participates in our working groups gets a vote. If you're a smaller organisation and you put in the time to collaborate with us, you can really punch above your weight.”

A brief history

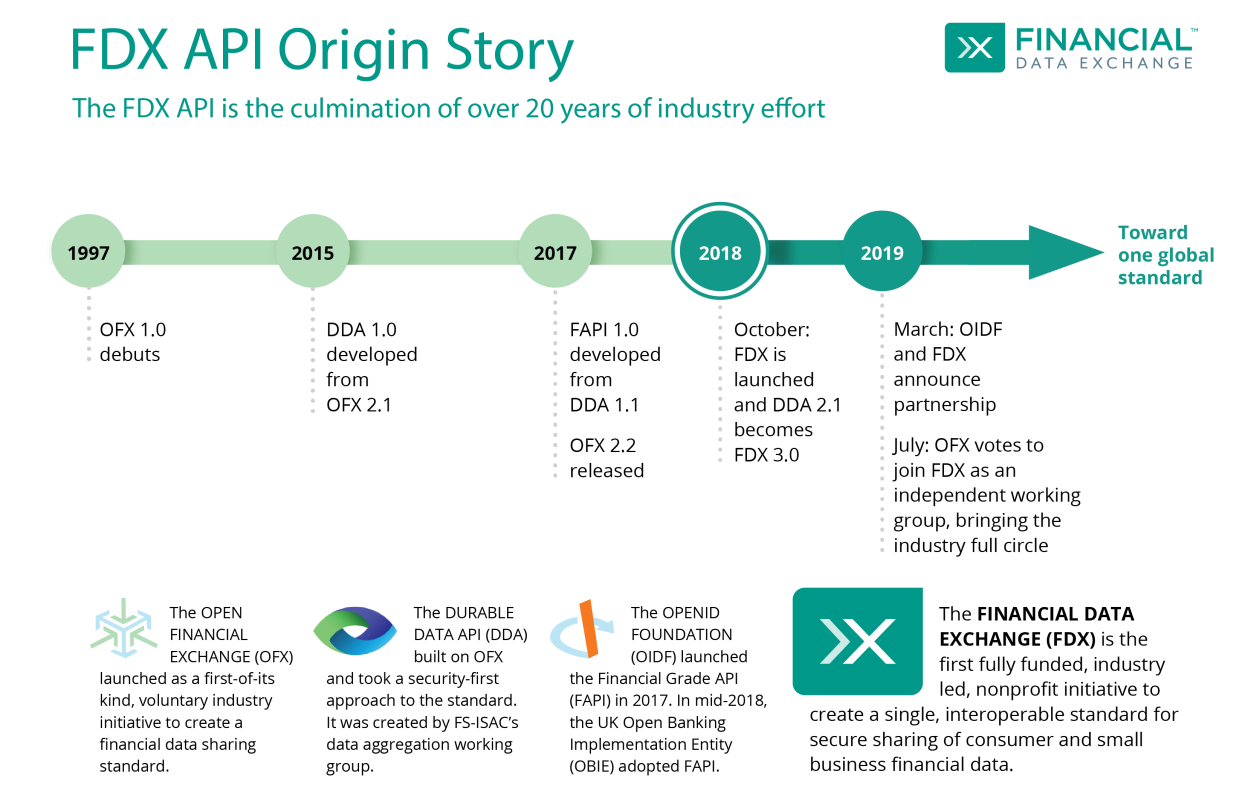

FDX officially launched in October 2018 as an independent subsidiary of FS-ISAC, which is an organisation dedicated to reducing cyber-risk in the global financial system.

Cardinal says: “Since then, we’ve seen steady growth of members and increasing adoption of the FDX API across the industry.

“The lineage of the FDX API is rooted in a 20-year history of data sharing in the financial industry. This started with the Open Financial Exchange (OFX) in 1997, and in July of this year, OFX joined with FDX.”

How does the API work?

The FDX API provides the rules for how data elements are defined and the channel of communication for the sharing of data to the parties involved in providing services to the consumer.

Cardinal says: “What our API does, in effect, is eliminate the need for screen scraping, which is where consumers would share their bank login credentials with third parties in order to get access to their services.

“Our API connects consumers' bank accounts with the services that need their data, ensuring that the consumer is the one choosing what to share and with whom.”

The latest version of the FDX API 3.0, describes a set of standards for data sharing. It lays out rules for how to request data, what data will be returned, as well as, in what format and how it will be encrypted.

“Around one-third (31%) of respondents said they would be less willing to do business with a company that makes payments via cheque.”

The FDX API provides the rules for how data elements are defined and the channel of communication for the sharing of data to the parties involved in providing services to the consumer.

Cardinal says: “What our API does, in effect, is eliminate the need for screen scraping, which is where consumers would share their bank login credentials with third parties in order to get access to their services.

“Our API connects consumers' bank accounts with the services that need their data, ensuring that the consumer is the one choosing what to share and with whom.”

The latest version of the FDX API 3.0, describes a set of standards for data sharing. It lays out rules for how to request data, what data will be returned, as well as, in what format and how it will be encrypted.

Don Cardinal, managing director at FDX