Covid takes its toll on payments deals

Total payments industry deals for June 2020 worth $786.54m were announced globally, according to GlobalData’s deals database.

The value marks a decrease of 30.8% over the previous month and a drop of 69.7% when compared with the last 12-month average of $2.6bn.

In terms of number of deals, the sector saw a rise of 25% over the last 12-month average with 45 deals against the average of 36 deals.

In value terms, North America leads the activity with deals worth $376.98m.

Top Payments industry deals June 2020

The top five payments deals accounted for 82.3% of the overall value during June 2020.

The combined value of the top five payments deals stood at $647.45m, against the overall value of $786.54m recorded for the month.

The top five payments industry deals of June 2020 tracked by GlobalData are:

1) Zip’s $301.36m acquisition of QuadPay.

2) The $150m venture financing of Checkout by Blossom Capital, Coatue Management, DST Global, Insight Venture Management, Singapore sovereign wealth fund and GIC.

3) Bpifrance, IDInvest Partners and Index Ventures’ $78.58m venture financing of Heroku.

4) The $76.5m acquisition of Digital Money Myanmar by Yoma Strategic Holdings.

5) Boku’s acquisition of Fortumo Holdings for $41m.

GlobalData tracks real-time data concerning all merger and acquisition, private equity/venture capital and asset transaction activity around the world from thousands of company websites and other reliable sources.

More in-depth reports and analysis on all reported deals are available for subscribers to GlobalData’s deals database.

Across the wider fintech sector, Covid is impacting mergers and acquisition activity more than financing.

Fintech M&A Q220 volume the lowest since Q213

Fintech M&A volume in Q2 of $8.1bn was the lowest since Q2 2013 and the number of transactions was the lowest since Q1 2014 at 162.

Significant deals in Q2 included several strategic transactions: SIX Group's $2.9 billion acquisition of a majority stake in BME, SoFi's $1.2 billion acquisition of Galileo and Mastercard's ~$1.0 billion acquisition of Finicity.

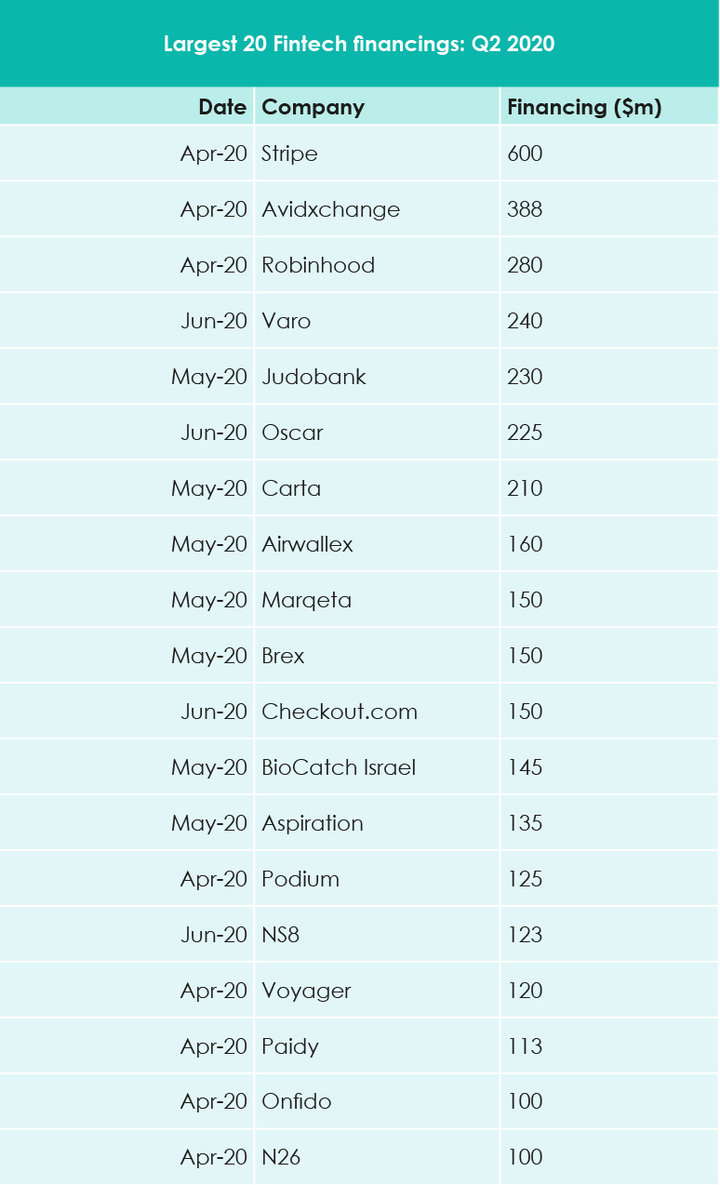

According to numbers from FT Partners, fintech financing in Q2 2020 of $9.5bn is the lowest since Q1 2018. But the number of financings (479 transactions) is the second highest quarterly count ever, behind only Q3 2019 (521 transactions).

The IPO market has been very active in spite of the global pandemic, with 12 FinTech IPOs globally in 2020 so far, including 8 in the second quarter alone.