Payment security trends that are transforming the financial sector

Change across the payments is in overdrive and it’s only going to get faster. The traditional methods of payments are being squeezed from all corners. Many of the issues surrounding traditional payments is security.

One thing that everyone agrees on is that security will remain crucial if the industry wants to stay afloat. The financial sector will be more proactive in their cybersecurity strategies. New legislation such as GDPR and Open Banking is forcing banks into a more transparent environment. That, of course, comes with risks. Continuing high-profile hacks plague financial organisations, setting about the motion to change security measures.

Thankfully security is moving away from being viewed as compliance box that needs to be ticked towards a critical strategy on its own. More and more financial institutions are focusing their efforts on both physical and cyber security.

Payment security trends: tokenisation

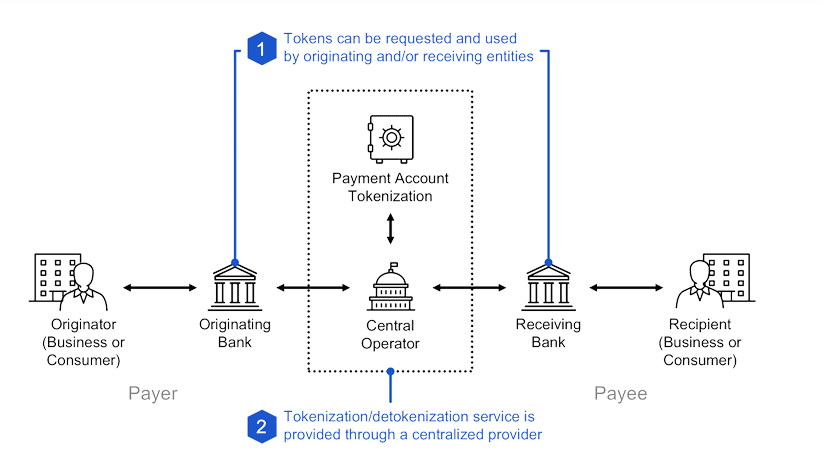

One payment security trend that is gaining prominence is tokenisation. It’s designed for banks, clearing houses and other financial organisation.

The software solution replaces sensitive account information with untraceable tokens.

Furthermore, each account number can be linked to multiple tokens. Each of those represents a different relationship, and domain controls can be applied to each to enforce those relationships. For example, this means that taxes can only be paid into a government account or bills can only be routed to a service company.

This radically reduces the risk of fraudulent attacks for business and also consumer transactions. In our faster, more connected world, tokenisation fits perfectly into the financial industry.

While reducing fraud, tokenisation supports a seamless integration for multiple use cases including push transactions between businesses, consumers and governments.

Biometric security

Biometric authentication for payments will play a key role for financial organisations.

There is a wealth of options that come with the payment security trend. Some companies opt for fingerprints and other use iris scans.

In addition, this removes the risk of stolen PIN numbers and fraud. The desire to ditch the PIN is one that is increasingly shared by consumers. Many would trust their banks to use biometric methods to replace PINs as long as the security was tight.

It’s fair to say that 2019 will see many financial organisations adopt biometric authentication solutions.

In April 2019, NatWest announced it was launching the UK’s first biometric bank card. This will allow people to verify payments over £30. It will also validate the user’s identity with the consumer’s fingerprint.

Bank cards used in the trial will store information. That way consumers can verify payments by placing their finger over a box on the card.

Optimising the mobile channel

More frequently than ever, customers bank through their mobile devices. Ensuring that the online channel is completely secure will not only protect customer data, it will build brand trust.

With the rise of digital banks such as Monzo, Revolut, Starling Bank and N26, consumers have benefited from instant access and a convenient mobile app for managing finances.

Consequently, there is a growing awareness that consumer financial security must be improved and quickly.

One relatively new development that is growing is the use of virtual cards. Every time a user makes an online payment with a Virtual Card, financial organisation will instantly detect the transaction and then automatically destroy those card details, generating new ones that will appear directly in the app.

Revolut brought this technology to its customers in March 2018. This will add an extra layer of security and protect customers against online card fraud, especially if the customer is making multiple online payments on a regular basis.